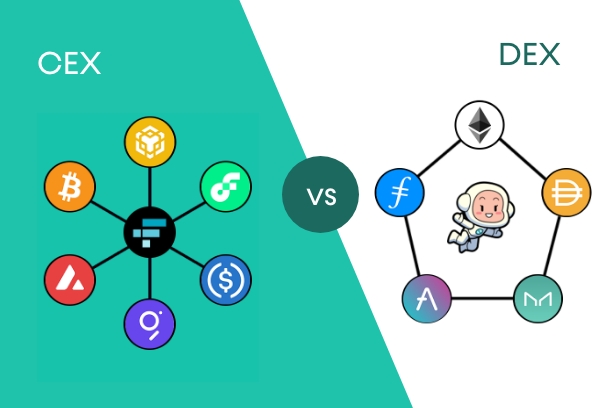

Cryptocurrency exchanges (CEX) and decentralized exchanges (DEX) both provide users with a platform for trading digital assets, but there are some key differences between the two. In this article, we’ll explore what CEX and DEX are, their advantages and disadvantages, and how they compare to one another.

Introduction

The cryptocurrency market is still relatively new and there are a variety of ways to trade digital assets. One of the most popular methods is through a cryptocurrency exchange or CEX. A CEX is a platform that allows users to buy, sell, and trade digital currencies. CEXs are typically centralized, meaning they are controlled by a single entity.

In contrast, decentralized exchanges (DEXs) are not controlled by a single entity. Instead, they are built on a distributed ledger technology (DLT) such as blockchain. This means that transactions are validated by a network of computers and no single entity has control over the platform.

Definition of CEX and DEX

A CEX is a centralized platform that allows users to buy, sell, and trade digital currencies. It is typically owned and operated by a single entity, which can be a company, an individual, or a group of individuals. CEXs are often regulated and require users to provide personal information in order to use the platform.

A DEX is a decentralized platform that allows users to buy, sell, and trade digital currencies. Unlike a CEX, a DEX is not controlled by a single entity. It is built on a distributed ledger technology such as blockchain, which allows users to transact directly with each other without the need for a middleman. DEXs are often unregulated and do not require users to provide personal information in order to use the platform.

Overview of CEX and DEX

CEXs are popular among traders because they are easy to use and typically offer a wide range of trading options. They also offer features such as margin trading, stop-loss orders, and advanced charting tools. However, CEXs are not without their drawbacks. They are vulnerable to hacking and other security threats, and there is a risk that the exchange could become insolvent and lose users’ funds.

DEXs offer many of the same features as CEXs, but they also offer some unique advantages. Because they are decentralized, they are not vulnerable to hacking and other security threats. They also offer more privacy, as users do not have to provide personal information in order to use the platform. However, DEXs can be difficult to use and their trading options are often limited.

Advantages and Disadvantages of CEX

CEXs offer a variety of advantages, including:

- Easy to use

- Wide range of trading options

- Advanced charting tools

- Regulated

However, CEXs also have some drawbacks, including:

- Vulnerable to hacking and other security threats

- Risk of insolvency

- Require users to provide personal information

Advantages and Disadvantages of DEX

DEXs offer a variety of advantages, including:

- Decentralized, not vulnerable to hacking and other security threats

- More privacy, as users do not have to provide personal information

- Low fees

However, DEXs also have some drawbacks, including:

- Difficult to use

- Limited trading options

- Unregulated

Conclusion

CEXs and DEXs both offer users a platform for trading digital assets, but there are some key differences between the two. CEXs are typically centralized and regulated, while DEXs are decentralized and unregulated.